Description

During the Civil War, the Confederate government sought ways to finance its military expenditures. Due to strong states’ rights sentiments within the South, the Confederacy’s central government was much weaker than the United States federal government in Washington, D.C. Therefore, Confederate authorities had comparatively less authority and support to levy direct taxes on the civilian population. While direct taxes (such as property taxes and a newly enacted income tax) on northern citizens made up approximately 20% of the U.S. government’s revenue during the Civil War, only around 8% of Confederate revenue throughout the war came from these same sources.

Confederate authorities sought more options to boost the central government’s coffers and fund the war effort. In August 1861, the Confederate Congress passed the “War Tax,” which taxed Southern citizens for certain luxury items and property valued $500 or greater, including taxes on enslaved people. The funds realized from that tax did not prove sufficient for the expanding costs of war, leading the Confederate government in 1863 to implement a graduated income tax that placed a one percent tax on the first $1,500 earned, and then a two percent tax on additional wages. A more substantial program emerged in April 1863, based on a tithing system of civilians providing ten percent of their agricultural products. Known as the Impressment Act, many of the provisions and supplies gathered from this policy went directly to the Confederate military. These measures led to some fraud and corruption, as well as protest from southern civilians and officials of government overreach, but overall did provide important financial and supply support to the Confederate war effort. (Wikipedia; American Battlefield Trust; Encyclopedia of Virginia; Texas State Library and Archives Commission)

See also: https://en.wikipedia.org/wiki/Confederate_war_finance

Related Subjects

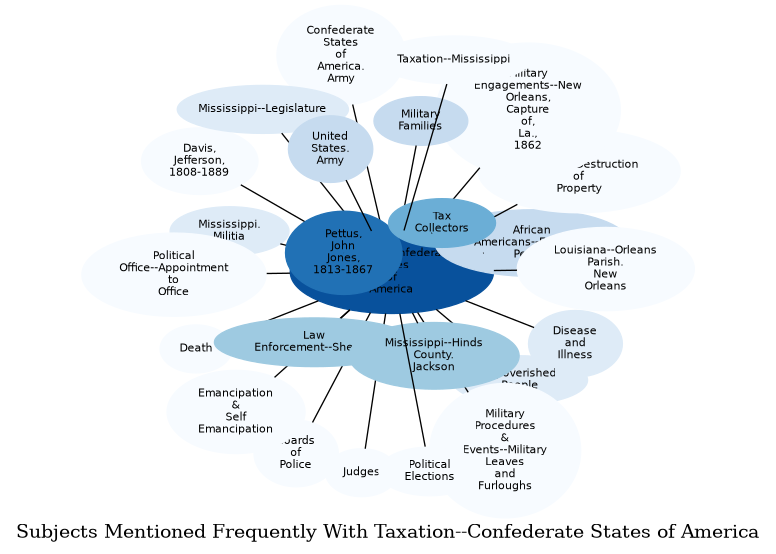

The graph displays the other subjects mentioned on the same pages as the subject "Taxation--Confederate States of America". If the same subject occurs on a page with "Taxation--Confederate States of America" more than once, it appears closer to "Taxation--Confederate States of America" on the graph, and is colored in a darker shade. The closer a subject is to the center, the more "related" the subjects are.