Pages That Need Review

s222_v098_x01_001

22

previous to the sale, the owner of such property may release the same by the payment of the taxes and charges for which the same was liable to be sold. In case any levy shall be made as aforesaid, the office making the levy shall be entitled to the same fees as are allowed the sheriff. If the property levied upon shall be sold for more than the amount of the taxes, costs and collection fees, the surplus shall be returned to the person in whose possession the said property was when the levy was made, or to the owner of the property.

Sec 78. All unpaid taxes and assessments may be collected by suit in courts of law or in equity. The commission may by resolution certify to the Town Attorney or Solicitor any unpaid taxes or assessments for collection, and if the taxes or assessments are collected without suit, he shall receive for his services such reasonable compensation as may be fixed by the commission, which shall be a lien upon said assessed property the same as the tax assessment. In case of suit, he shall receive such reasonable compensation for his services, not exceeding one-half of the taxes due as may be fixed by the court; such attorney's or solicitor' fees shall be added to the amount of taxes due, and shall be a lien upon the property equally therewith.

Sec 79. If any tax or assessment on real estate shall not be paid before the first day of December next after the tax roll shall have come into the hands of the Collector, the Commission may at any time thereafter by resolution require the Collector to make and certify an extract from the duplicate assessment roll which extract so certified shall be admissible in evidence in any court with like effect as the duplicate assessment roll, showing the description and assessment of any lot, tract or parcel of land as the same then appears together with the amount of tax levied thereon or assessment payable in repect thereof. The Town Attorney or Solicitor shall search or cause to be searched the public records of St. Lucie County to ascertain the names of all persons owning said land or having interests in or liens upon said land, in the suits brought for the enforcement of said liens for taxes, he shall make all persons appearing upon said records to be owners of or interested in said suits upon any defendant by publication, the notice shall contain a description of the land upon which the tax lien is claimed. The names of any person other than the owner of

23

said estate, may at the direction of the Town Attorney or Solicitor be omitted from the list of defendants, but no person having an interest in said property or a lien thereon, apparent upon said records, and not brought into court as a defendant, shall be, until so brought into court deprived of his interest therein or lien thereon. The interests of all persons not apparent upon said public records shall be foreclosed by such suits without their being named or served as defendants. Upon collection of all monies due the Town upon any such tax or assesment which shall have been placed in the hands of the Town Attorney or Solicitor for collection, application thereof shall be made in the following order of priority to payment of: First, all court costs, including clerks, Sheriffs, Master's and advertising fees; Second, the amount due the Town for taxes or assesments and interest thereon; and last, the Attorney's or Solicitor's fees for service in connection with the collection of such taxes or assesments.

Sec 80. In the imposition, assessment, levy and collection of annual license taxes the Commission, by resolution or ordinance, shall have power to act independently of the general law relating to State and County licenses, with respect to the designation of professions, occupations, businesses and trades, and the amounts of all licenses, and the term and method of payment and collection thereof.

Streets and Sidewalks.

Sec 81. The territory contained wihin the corporate limits of the Town of Fellsmere is hereby declared to be and the same is hereby constituted an independent road district.

Sec 82. The Commission shall have complete control and supervision of all the streets, roads and alleys within the corporate limits of the Town.

Sec 83. Persons subject to road duty under the laws of the State of Florida may be made subject to road and street duty within the corporate limits of the Town of Fellsmere, provided they reside within the corporate limits of said Town, and have resided therein for six

24

months.

Sec. 84. Whenever the County Commissioners of St. Lucie County, Florida shall levy and collect a road and bridge tax for the purpose of keeping up the roads and bridges in said County, one-half of the taxes so levied and collected on the property, both real and personal, within the corporate limits of the Town of Fellsmere shall be turned over and paid annually by the said County Commissioners to the Town of Fellsmere to be used by it in working, repairing, improving and laying out the streets thereof.

Sec 85. The Commission shall have authority, when deemed necessary or advisable, to levy in each year an extra street tax of not to exceed three dollars on each male resident of said Town over the age of twenty-one years, and under the age of fifty-five years, and shall have authority to enforce the collection of same.

Sec. 86. The Commission is hereby authorized, by ordinance, to provide for and ordain the construction and repair of sewers, drains, street pavements, curbs, gutters, sidewalks and foot pavements upon any street, park or other public place in said Town at the cost of the owner of lots or parcels of land abutting thereon; or by ordinance to regulate require and ordain such construction or repair by said owners, respectively, and if the owner or owners of any lot shall fail to comply with the provisions of said ordinance, the Commission of said Town may have such sewers, drains, street pavements, curbs, gutters, sidewalks or foot pavements constructed or repaired along and in front of any such lot or parcel of land. The cost of such construction or repairing, with interest thereon from the date of the completion of such work shall be a lien superior to all other liens, excepting only liens for taxes, upon each lot or parcel of land along and in front of which such improvements have been constructed or repaired, and the cost thereof, bearing interest at the rate of twelve per cent. per annum, may be assessed as a special tax against the lot or parcel of land along or in front of which such sewers, drains, street pavements, foot pavements, curbs, gutters or sidewalks were constructed or repaired; or the lien for the cost thereof, with interest as aforesaid may be enforced against the property by suit at

25

law or in equity. As soon as practicable, and within thirty days after construction or repair of any such sewer, drain, street pavement, foot pavement, curb, gutter or sidewalk, the Commission shall have prepared a statement of the cost thereof, and shall have entered up in a book, which shall be prepared for that purpose, and kept open to the public inspection during reasonable office hours in the office of the secretary, marked "Street Improvement Lien Book" the amount of such cost, the date of the completion of the work, the lot upon which a lien is claimed, and such other information as the Commission may deem advisable; Provided, however, that if the cost of such construction or repair shall be paid to the Town within thirty days after the completion of the work, no interest thereon shall be charged. The Commission shall have the power to charge all or any part of the cost of such improvements as a lien against any such contiguous or abutting property, apportioning the cost thereof acording to the area, value of frontage thereof, and their judgments as to the benefits received and the apportionment of the cost among the parcels deemed to be benefited, shall be conclusive upon the proprty owners and the courts. The construction of such improvements, and entry of such lien in said Street Improvements Lien Book shall be notice to all persons having interests in the property affected thereby, of the existence of such lien. Provided, however, that any persons owning any lot, or owning any interest therein, or having a lien thereon, shall have the right, within thirty days after the completion of the said swever, drain, street pavement, foot pavement, curb, gutter or sidewalk to present to the Clerk a sworn petition to the Commission, stating his interest in the property, and alleging that in the opinion of the petitioner, the cost of such proportion thereof of such sever, drain, street pavement, foot pavement, curb, gutter or sidewalk as has been assessed and entered up in said Street Improvement Lien Book against said lot, exceeds the actual cost thereof, or that such cost has been erroneously entered, or that the apportionment thereof is unequal or unreasonable. If such petition is presented within such time to the Clerk, the Commission shall hear and consider the petition and make due and proper inquiry into the question involved, and if it shall appear to their satisfaction that the cost as entered up exceeds the actual cost thereof or has been erroneously entered, or that the apportionment thereof is unequal or unreasonable, or exceeds the special benefits accruing to the lot by reason of the improvement, then the Commission shall by resolution, so declare, and shall have the entry thereof in the Street Improvement Lien Book

26

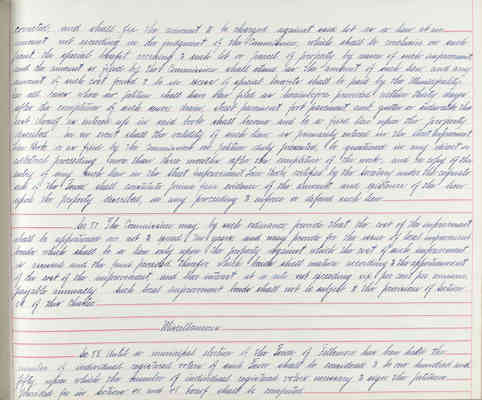

corrected, and shall fix the amount to be charged against said lot as a lien at an amount not exceeding in the judgment of the Commission, which shall be conclusive on such point, the special benefit accruing to such lot or parcel of property by reason of such improvement, and the amount so fixed by the Commission shall stand as the amout of such lien, and any amount of such cost found to be in excess of special benefits shall be paid by the Municipality. In all cases where no petition shall have been filed as hereinbefore provided within thirty days after the completion of such sewers, drain, street pavement, foot pavement, curb, gutter or sidewalk, the cost thereof as entered up in said book shall become and be a fixed lien upon the property described. In no event shall the validity of such lien, as primarily entered in the Street Improvement Lien Book, or as fixed by the Commission on petition duly presented, be questioned in any direct or collateral proceeding more than three months after the completion of the work, and a copy of the entry of any such lien in the Street Improvement Law Book, certified by the Seretary under the corporate seal of the Town, shall constitute prima facie evidence of the amount and existence of the lien upon the property described, in any proceeding to enforce or defend such lien.

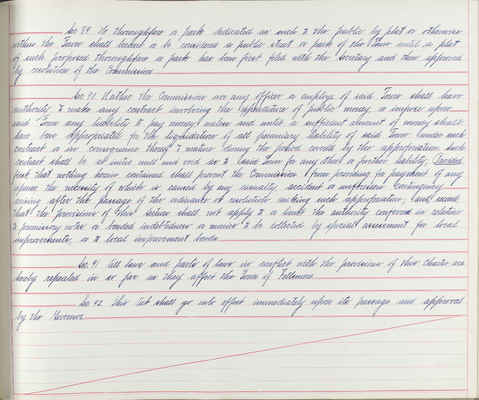

Se 81. The Commission may, by such ordinance, provide that the cost of the improvement shall be apportioned over not to exceed ten years, and may provide for the issue of local improvement bonds which shall be a lien only upon the property against which the cost of such improvement is assessed and the fund provided therefor, which bonds shall mature according to the apportionment of the cost of the improvement, and bear interest at a rate not exceeding six per cent per annum, payable annually. Such local improvement bonds shall not be subject to the provisions of Section 55 of the Charter.

Miscellaneous

Sec 88. Until a municipal election of the Town of Fellsmere has been held the number of individual registered voters of said Town shall be considered to be one hundred and fifty, upon which the number of individual registered voters necessary to sign the petitions provided for in Sections 40 and 48 hereof shall be completed.

27

Sec. 89. No thoroughfare or park dedicated as such to the public by plat or otherwise within the Town shall become or be considered a public street or park of the Town until a plat of such proposed thoroughfare or park has been first filed with the Secretary and then approved by resolution of the Commission.

Sec. 90. Neither the Commission nor any officer or employe of said Town shall have authority to make any contract involving the expenditure of public money or impose upon said Town any liability to pay money, unless and until a sufficient aount of money shall have been appropriated for the liquidation of all pecuniary liability of said Town under such contract or in consequence thereof & mature during the period covered by the appropriation. Such contract shall be ab initio null and void as to said Town for any other or further liability; Provided, first, that nothing herein contained shall prevent the Commission from providing for payment of any expenses, the necessity of which is caused by any casualty, accident or unforseen contingency arising after the passage of the ordinance or resolution making such appropriation; and, second, that the provisions of this Section shall not apply to or limit the authority conferred in relation to promissory notes or bonded indebtdness or monies to be collected by special assessment for local improvements, or to local improvement bonds.

Sec. 91. All laws and facts of laws in conflict with the provisions of this charter are hereby repealed in so far as they affect the Town of Fellsmere.

Sec, 92. This Act shall go into effect immediately upon its passage and approval by the Governor.

28

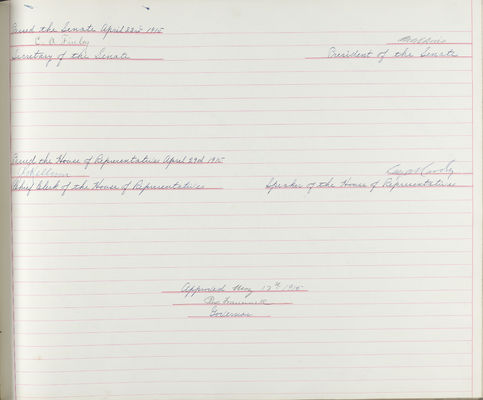

Passed the Senate April 23rd 1915 [signed] C.A. Finley Secretary of the Senate

[on the righthand side] [illegible signature] President of the Senate

[on the lefthand side] [signed] J.G. Kell??? Chief Clerk of the House of Representatives

[on the righthand side] [illegible signature] Speaker of the House of Representatives

[centered on the page] Approved May 12th 1915 [illegible signature] Governor

29

[3 paragraphs, separated, and written at a 45 degree angle]

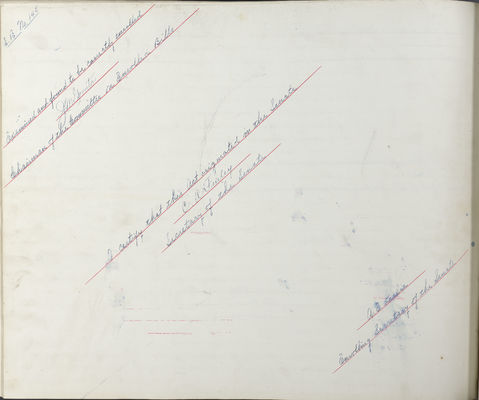

Examined and found to be correctly enrolled [signed] J. M. Gornta Chairman of the Committee on Enrolled Bills

I certify that this Act originated in the Senate [signed] C. A. Finley Secretary of the Senate

[signed] A. E. Leslie Enrolling Secretary of the Senate