Pages

Page 41

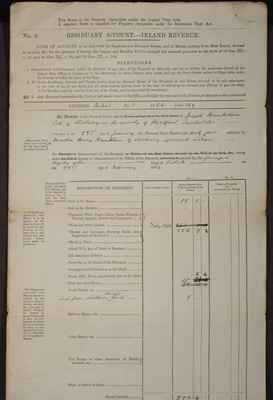

This Form is for Property chargeable under the Legacy Duty Acts. A separate Form is supplied for Property chargeable under the Succession Duty Act.

No. 3 RESIDUARY ACCOUNT. INLAND REVENUE.

FORM OF ACCOUNT to be delivered (in Duplicate) of Personal Estate, and of Monies arising from Real Estate, devised to be sold, &c., for the purpose of having the Legacy and Residue Duties charged and assessed pursuant to the Acts of 36 Geo. III., C. 52, and 45 Geo. III., C 28, and 55 Geo. III., c. 184. DIRECTIONS 1. Executors and Administrators, before the Retainer of any Part of the Property to their own use, are to deliver the particulars thereof at the Legacy Duty Office, in London, or to the Distributor in whose District they reside, and pay the Duty thereon within 14 Days after, under the Penalty of treble the value of the Duty. 2. All Rents, Dividends, Interest, and Profits arising from the Personal Estate of the Deceased or real EState, directed to be sold subsequent to the time of his or her death, and all accumulations thereof, down to the time of delivering the Account and offering to pay the Duty on the Residue, must be considered as part of the Estate, and be accounted for accordingly. 3. Any account transmitted by Post, or left under cover at the Office, will either be returned to the Parties, or thrown aside unnoticed REGISTER Intest No. 1 1864 Folio 127

An Account of the Personal Estate, {and of Monies arising out of the Real Estate} of Joseph Brinklow late of Aldbury in the county of Hertford Tunholder - who died on the 23rd day of January One Thousand Eight Hundred and sixty four exhibited by Martha Mary Brinklow of Aldbury aforesaid widow -

the {Executor or} Administrator of the Deceased, {or Trustee of the Real Estate, directed by the Will to be Sold, &c.,} acting under {the Will or} Letters of Administration of the Effects of the Deceased, {proved in, or} granted by, the Principal Registry of the ------ Court of Probate ----- on the 23rd. day of February 1864.

Page 42

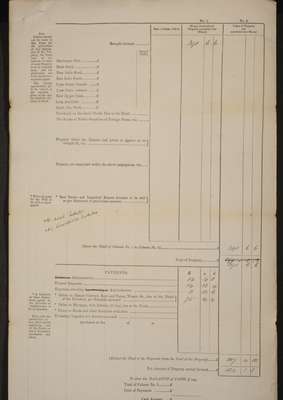

No.1 No.2 Date of Sales, if Sold Money revieved and Property converted into Money 291.66 Value of Property not converted into Money

Note. If there should not be room in this Form for the particulars of any description of the Property, the Total only of the amount of value of such Property is to be inserted here, and the particulars are to be stated on a separate paper. The Stocks unconverted are to be valued at the medium price of the day on which the Account is dated.

Brought forward...........

Price of Stocks

Exchequer Bills............£ Bank Stock...................£ East India Stock............£ 3 per Cents. Consols ....£ 3 per Cents. reduced ....£ New 3 1/4 per Cents. ....£ Long Annuities ...........£ South Sea Stock............£ Dividends on the above Stocks Due at the Death ............... The Stocks or Public Securities of Foreign States, viz. ........

Property which the Testator had power to appoint as he thought fit, viz. ......................................}

Property not comprised within the above descriptions, viz.. . ...

*When directed by the Will to be sold or mortaged. * Real Estate and Leasehold Estates directed to by sold as per Statement of particulars annexed ..................}

No real Estate No leasehold Estates

(Insert the Total of Column No. 1 in Column No.2)...................................................£ Total of Property................£

PAYMENTS

Administration........................................................................ Funeral Expenses.................................................................... Expenses attenting Administration........................................... * Debts on Simple Contract, Rent and Taxes, Wages, &c., due at the Deat of the Deceased per Schedule annexed..............................................}

* Debts on Mortgage, with Interest, (if any) due at the Death.............................. * Debts on Bonds and other Securities with ditto............................................... * Debts on Bonds and other Securities with ...................................................... Pecuinary Legacies per Account annexed........................................................ purchased on the of at

* A Schedule of these Deductions signed by the Ezecutor or Administrator is to be annexed.

Here state the particulars of any other lawful payments, and of the Funds or other Securities purchased, and when.

£ 14 14 2 75 s. 4 13 12 14 d. 8 4 6 4

(Deduct the Total of the Payments from the Total of the Property)........£ Net Amount of Property carried forward.......£

To show the BALANCE of CASH, if any. Total of Column No. 1.............£ Total of Payments ..................£ Cash Account.........................£

Page 43

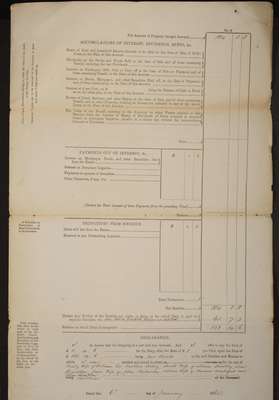

Net Amount of Property brought forward

ACCUMULATIONS OF INTEREST, DIVIDENDS, RENTS, &c.

Rents of Real and Leasehold Estates directed to be Sold to the time of Salfe, if Sold; if not, to the Date of this Account

Dividends on the Stocks and Funds Sold to the time of Sale and of those remaining Unsold, including the last Dividends

Interest on Exchequer Bills Sold or Paids off to the time of Sale or Payment, and of those remaining Unsold, to teh Date of this Account

Interest on Bonds, Mortgages, and other Securities Paid off, to the Day of Payment, and of those outstanding, to the Date of this Account

Interest at 4 per Cent, on

Page 44

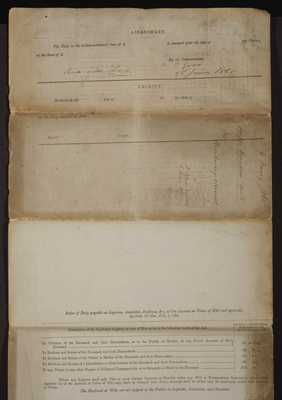

This page is not transcribed, please help transcribe this page