Pages

96

- 2 -

I felt as reasonably certain as a lawyer knowing the disposition of all courts on bond questions ought to feel, but of advisability, my duty was to build the defense, provide for its legality and tender it to the council for passage on by them as to the question of advisability. The council has passed on the question.

Having practically said that it was not advisable, the duty still devolves on me as I see it to devise ways and means by which in a legal way we can prevent the forced suspension of the city government until, as nearly as possible, the meeting of another Legislature.

To this end I woudl state that in my opinion the answer of the city and its officers to the mandamus proceedings should be merely the setting out of the factss with reference to the interest money now on hand, which, of course, is a matter of some complication, but I think that from the facts as they can truly be set forth I feel little doubt that the Federal Court can order the payment of its judgment out of that fund.

If it does so no judgment which can be enforced by mandamus proceedings will exist against the city.

It will not in the slightest degree interfere with our appeal in the bond case. It will save the city interest because we are paying interest on the judgment.

It will protect the city officers which is a matter of grave importance in a situation of this kind when the giving of a positive opinion as to how money on hand in the interest fund could be deposed of, would be one of the gravest for the ablest lawyer.

I desire to call your attention to the fact that the jurisdictional question raised in the city bond case cut the judgment to such proportions that in case the court holds it must be paid, we have the money on hand with which to pay it. Whereas had judgment been rendered for the whole amount claimed, it could not have been done and the tax question would have been now upon us.

As it is, if the court holds that we must pay this money and we do pay it, it will be in the fall of the year 1904 before it is possible for our finances to be seriously disturbed by the Federal or any other

97

-3-

court and any hitch whatever will defer the evil day. What the morrow may bring forth no man knows, and the conditions that may exist here in the fall of 1904 may be such that no appeal to the Legislature of January 1905 may be necessary. I would advise that if the court order the money paid out of funds on hand, that no appeal be taken.

Of course, if the court will not so order and steps are taken to interfere with the taxes,as a matter of protection I must advise as a lawyer that advantage be taken of every point so that after the battle is over I can further advised of your further pleasure. I regard the probability of a legal battle over the question of an interference with our taxes as very remote.

I only advise an answer as hereinbefore set out, because I believe that justice to the other bond holders demands that we lay before the court the facts and let him decide the right. Feeling that a technical point upon which the city won has placed us in a position where we can at least defer the doom which so many persons seem to think impending over the city until its effect will be, to say the least minimized, I request that you advise me as to my future action in the mandamus proceeding.

EC Orrick City Atty

99

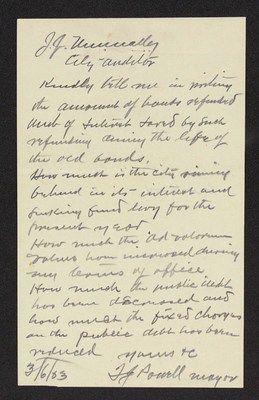

J.J. Nunnally City Auditor

Kindly bill me in writing the amount of bonds refunded and of interest saved by such refunding during the life of the old bonds.

How much is the city running behind in its interest and sinking fund levy for the present year.

How much the Ad volorum values have increased during my terms of office

How much the public debt has been decreased and how much the fixed charges on the public debt has been reduced

yours &c TJ Powell Mayor

3/6/03

100

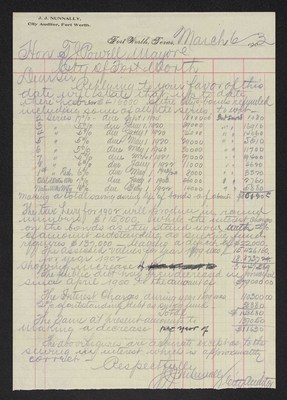

J. J. NUNNALLY, City Auditor, Fort Worth.

Fort Worth, Texas, March 6 1903

Hon T. J. Powell, Mayor City of Fort Worth

Dear Sir

Replying to your favor of this date will state that up to date there has been $416000 of the City's bonds refunded inclusing some of all the series to wit:-

| 2 series 7% due Sept 1904 | 18000.00 | Int Saved | 1080 |

|---|---|---|---|

| 3 " 5% due Jany 1 1920 | 89000 | " " 16910 | |

| 4 " 5% due Jany 1 1920 | 74000 | " " 14060 | |

| 5 " 5% due May 1 1920 | 29000 | " " 5510 | |

| 6 " 5% due May 1 1940 | 30000 | " " 11700 | |

| 7 " 5% due Mch 1 1921 | 97000 | " " 19400 | |

| 8 " 6% due Jany 1 1922 | 11000 | " " 4620 | |

| 1st " Red. 6% due May 1 1903/23 | 8000 | " " 3320 | |

| Old Water Wks 7 % due Jany 1 1902 | 46000 | " " 2760 | |

| Water Wks Mtg 6% due Feby 1 1922 | 14000 | " " 5880 | |

| Making a total saving during life of honds of about | $80120.00 |

The public debt has been decrease in principal since April 1900 to the amount of $79000.00

The Interest Charges during year 1899 was 110300.00 2% of outstanding debt as sinking fund 38380 Total $148680

The same at present amounts to 137050 making a decrease per year of $ 11630

The above figures are accurate except as to the saving in interest which is approximately correct

Respectfully JJ Nunnally City Auditor