Pages That Mention H W Scott

990150

990150_Page_04

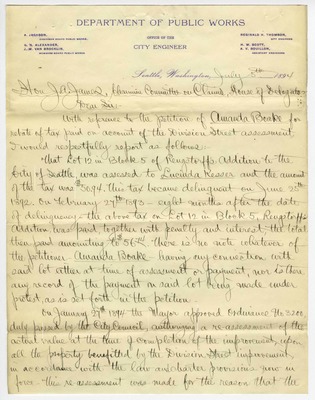

Department of Public Works Office of the City Engineer Reginald H Thompson, City Engineer H W Scott, A V Bouillon, Assistant Engineers A Jackson, Chairman Board Public Works G N Alexander, J W Van Brocklin, Members board Public Works Seattle, Washington, July 5th, 1894 Hon. J A James, Chairman Committee of Claims, House of Delagates Dear Sir, With reference to the petition of Amanda Boake for rebate of tax paid on account of the Division Street Assessment I would respectfully report as follows:That Lot 12 in Block 5 of Renstorff's Addition to the City of Seattle was assessed to Lucinda Kesser and the amount of the tax was $50.94. This tax became delinquent on June 25th 1892. On February 27th 1893 eight months after the date of delinquency, the above tax on Lot 12 in Block 5 Renstorff's Addition was paid together with penalty and interest, the total then paid amounting to $56.74. There is no note whatever of the petitioner Amanda Boake having any connection with said lot either at time of assessment of payment nor is there any record of the payment on said lot being made under protest as is set forth in the petition. On January 27th 1894 the Mayor approved Ordinance No 3200 duly passed by the City council authorizing a re-assessment of the actual value at the time of completion of the improvement upon all the property benefitted by the Division Street Improvement in accordance with the law and charter provisions now in force. this re-assessment was made for the reason that the

990150_Page_05

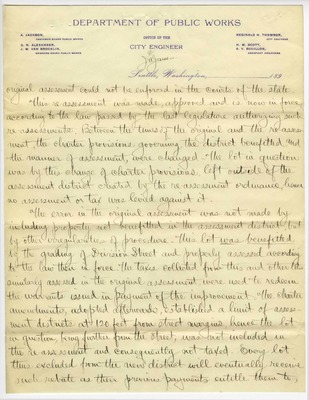

Department of Public Works Office of the City Engineer Reginald H Thompson, City Engineer H W Scott, A V Bouillon, Assistant Engineers A Jackson, Chairman Board Public Works G N Alexander, J W Van Brocklin, Members board Public Works 2 J A James Seattle, Washington, original assessment could not be enforced in the courts of the state This re-assessment was made, approved and is now in force, according to the law passed by the last legislature authorizing such re-assessments. Between the times of the original and the re-assessment, the charter provisions governing the district benefitted and the manner of assessment, were changed- the lot in question was by this change of charter provisions left outside of the assessment district created by the re-assessment ordinance, hence no assessment or tax was levied against it. The error in the original assessment was not made by including property not benefitted in the assessment district but by other irregularities of procedure. The lot was benefitted by the grading of Division Street and properly assessed according to the law then in force. The taxes collected from this and other lots similarly assessed on the original assessment were used to redeem the warrants issued in payment of the improvement. The charter amendments adopted afterwards established a limit of assess-ment districts at 120 feet from street margins hence the lot in question being further from the street was not included in the re-assessment and consequently not taxed. Every lot thence excluded from the new district will eventually receive such rebate as their previous payments entitle them to,

990150_Page_06

Department of Public Works Office of the City Engineer Reginald H Thompson, City Engineer H W Scott, A V Bouillon, Assistant Engineers A Jackson, Chairman Board Public Works G N Alexander, J W Van Brocklin, Members board Public Works 3 J A J Seattle, Washington, not as a matter of righting a supposed injustice, but the good fortune of a change in the charter provisions of the city governing assessment districts. Had these changes or amendments not been made, the re-assessment would have been no doubt as to its legality- Hence is seems to me that owners of lots situated with reference to re-assessments as is the lot in question, ought not to expect to recap the results of this good fortune until the re-assessed taxes are collected and the claims against the street satisfied. the excess of taxes collected should then be rebated as provided by the charter The records of the City Tresurer's office would seem to indicate at time of original assessment or payment, and the presumption would be that this tax was paid before she purchased the property- If true, this presumption would not affect the claim of the owner of the lot for an eventual rebate, but would tent to strengthen the position of the city against an immediate demand. However this may be as regards the question of ownership I see no way of settling any of these rebates until all claims against the local improvement fund are satisfied. per Geo F Cotterel Right of Way Deputy Very Respectfully yours R S Thomson City Attorney

SEACPM18831109

SEACPM18831109_Page_3

397 COMMON COUNCIL OF THE CITY OF SEATTLE Nov 9/83 Bersch & Hink License money refunded $75. Dr. E L Smith Health Officer 75. Dr. Mary Brown Reporting Births 5. Cochran & Robb Team numbers 1. Road Fund C L Mitchell Repairing Harness $8.50 Chas Robinson Road Poll tax refunded 4. Jackson Street Improvement #398 G N Alexander Final Payment $5982.68 J M Snow Engineering 26. J E Monroe Engineering 24.75 R Munch Engineering 14. A Gardiner Engineering 7.50 W L Cochran Engineering 2.48 H W Scott Engineering 2.40 J W Turner Engineering 2.07 New Business Ordered that the Attorney be & he is hereby instructed to submit an Ordinance to repeal all requirements for charging fees for Issuing licenses. Ordered that the Attorney be & he is hereby instructed to proceed to remove all fish stands foot of Columbia Street. Ordered that the Clerk be & he is hereby instructed to re-advertise for bids for the Improvement of Columbia Street under Ordinance #476. Ordered that the order heretofore made & entered on page 390 authorizing the issuing of a Retail liquor license to H J Curtis be & the same is hereby revoked. Consideration of Ordinances An Ordinance us submitted by the Attorney to prevent the obstruction of Streets. re-referred to theAttorney with instructions to consult with Street Committee thereon. [?] submitted by the Attorney [?] Ordinance

SEACPM18831122

SEACPM18831122_Page_2

400 JOURNAL OF THE PROCEEDINGS OF THE Nov 22/83 Washington Street Improvement #369 G N Alexander Contract Work Final Payment $3264.13 J M Snow Engineering 18. H Tilly Browne Engineering 9. Albro Gardner Engineering 7.50 J E Monroe Engineering 6.87 H W Scott Engineering 4.95 W L Cochran Engineering 4.95 J F Wilson Engineering 4.95 J W Turner Engineering 3.75 Wm Wilde Engineering 1.65 J M Gordon Engineering 1.37 South 3rd St Improvement #399 Strong & Harkins Contract Work Final Payment $3645.24 J M Snow Engineering 18. J E Monroe Engineering 19.25 H Tilly Browne Engineering 16.50 R Munch Engineering 14. Albro Gardner Engineering 7.50 Wm Wilde Engineering 7.42 J F Wilson Engineering 6.60 H W Scott Engineering 4.12 W L Cochran Engineering 4.12 J M Gordon Engineering 3.44 J W Turner Engineering 3.12 Consideration of Ordinances Ordered taht the mater of considering the Veto of His Honor the Mayor to an Ordinance to amend ordinance No 410 be & he is the same is hereby laid over until next regular meeting. Ordered that the consideration of the Ordinance entitled "To fix the salary of Fire Warden" thereupon after due consideration the same is adopted upon the following vote to wit: In favoe of adoption Clancy, Day, McDonald, Ranke & Wusthoff. Against adoption none. Ordered that an Ordinance entitled "to repeal Ordinance No 313 be & the