Pages

16

15

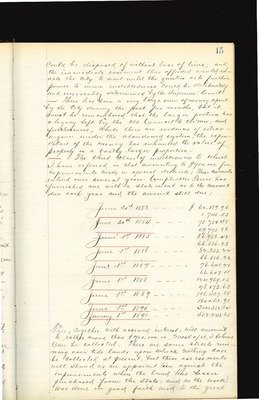

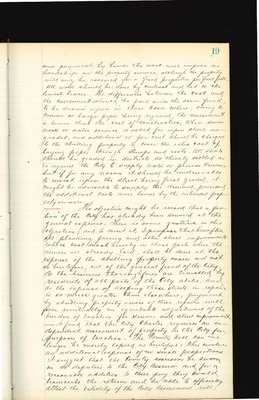

could be disposed of without loss of time; and the immediate easement this afforded would enable the City to wait until the question as to further power to incurindebtedness could be deliberately and irrevocable determined by the Supreme Court there has been a very large sum of money spent by the City during the past few onths, but it must be remembered that the larger portion had a legacy left by the Old Council the new, and furthermore, while there are evidences of extravangance under the abandoned system, the expenditure of the money had enhanced the value of properly in a vastly larger proportion. The Third class of indebtedness to which I have referred is that amounting to $700,000. for improvements made in special districts; These amounts furnished me with a statement as to the amount due each year and the amount still due: June 30th 1883 $60,189.90 1,745.55 June 30th 1884 $78,750.38 49,771.88 June 1st 1885 $86,983.42 66,516.25 June 1st 1886 $82,353.22 66,516.23 June 1st 1887 $76,641.21 66,607.11 June 1st 1888 $124,969.05 98,073.65 June 1st 1889 $196,437.88 160,463.91 June 1st 1890 $304,350.84 January 1st 1891 $502,243.35 This together with accrued interest will amount to rather more than $700,000.00. Most of it I believe can be cancelled. There are some streets run ning over tide lands upon which nothing can be collected at present but these assessments will stand as an apparent lien against the improvements when the land has been purchased from the state and as the work was done in good faith and to the great

17

16

profit of the residents it is only just that the City claim should from a cloud in the title There are other cases where it would seem to be only equitable that a reassessment should be made, and possibly the City generally bear a part of the expense in exceptional instances, but these do not constitute a formidable sum. As to the other cases, I am of opinion that the defense set up of negligence on the part of the City cannot be maintained The City is not expected by law to dun its debtors. The legal announcement of improvements was made and failure to restrain the City is presumptive evidence of consent. The successive notices were duly served and the claim of the City became a lien upon the property which has never been released. I recommend that the City Treasurer give thirty days notice that these delinquent taxes must be paid forthwith; and that the council empower him to receive installments of not less that one-sixth of each sum per month until all is paid in; taking the streets seriatim fro, the oldest districts down. As he reaches as objection which exceeds his power to overcome, he should report to the Council, which should thereupon direct the Corporation Counsel to secure the necessary assistance and at once begin suit against Contumacious delinquents and proceed according to law or advise the Council, when in his judgment, some other course had better by pursued. the Corpoation Counsel should make a monthly dreport to the Council of the Condition of each district I desire to all your attention to the absolute necessity of curtailing all expenses. this is not retrenchment arising from a weak financial condition; it is simply a return from very extroadinary expenses to those justified by current necessitites. I would remind you that the old City Council took a very important time to reduce the tax levy, For 1890 it was 12 mills; the Council reduced it for this year to 10 mills and thus deprived the City Government of $52,000.00, at a time when even an additional levy would not have been resented by people who were clamoring for improvements of all kinds; but making allowance for that, the tendency to laxity when once

18

17

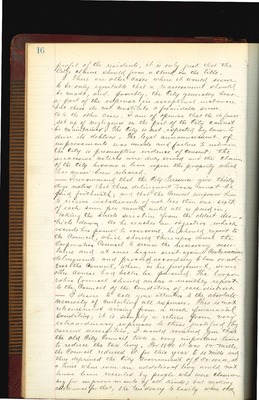

a line of credit is opened should receive a firm and ernest check at the hands of the city Council whose function it is to limit the expenditure of the several departments. I call your attention to the statement furnished me by the city Treasurer to March 1st 1891. Showwing the amount of taxes paid in The entire amount of City taxes for the year is $264,000.00 of which $208,000.00 has been collected up to March 1st leaving $56,000.00 delinquent at that date. The amounts recently derived by the City from fines imposed by the Police Court are as follows: November 1890 $1791.80 December 1890 $3576.00 January 1891 $4260.00 February 1891 $ 363.75 This falling off must be taken into account in estimating the current board upon the average of last year with a presumptive increase which was fully responded to by the first month of 1891 If it is too early to segregate the total receipts among the several funds to the end of February, but the following statement up to February 1st is presented:

Street Light Fund Surplus $1966.56 Park Fund Surplus $6814.96 Libraray Fund Surplus $6586.85 Harbor & Wharf Fund Surplus $ 149.49 Total $15,515.86

Fire Fund Indebtedness $133,756.38 Street Fund Indebtedness $404,790.86 Water Fund Indebtedness $217,721.65 General Fund Indebtedness $ 54,783.19 Salary Fund Indebtedness $ 22,651.64 Sewer & Drainage Fund Indebtedness $ 23,524.45 Health Fund Indebtedness $ 2,930.03 Police Fund Indebtedness $ 2,086.92 Total $862,225.32

Of this indebtedness $217,721.65 (Water Fund) and $23,524.45 (Sewer & Drainage Fund) is to be

19

18

funded by the issueance of the "Seattle Water and Sewer Bonds" so that the net indebtedness at that date was $605,463.36 There have been issued on the general Fund warrants amounting to $63,436.26 in satisfactionof judgements against the City payable six months after date and which are included. I do not wish to appear as an alarmist, but I should be derelict in my duty of I did not warn you that the current expenses of the City are largely in excess of the estimated income. The salary list and the amount available to meet it, together with an estimate of the inevitable deficiency had been presented to you, at your own request by the City Comptroller, but Ido not find that you have taken any action on the matter I earnestly recommend that the Police and Fire Department be restricted to the closest economy without impairing their usefulness, to also modify the working force of other departments. The people who voted for the eight hour law will concede the necessity of the additional expense involved in the applicationof a sound princil[e whichhad , I may add, my most cordial approval. I admit that the aggregate expense thereby added looks loarge, but at quite insignificant compared to the great moral advantage gained by the City, Nevertheless, it is a fact that it invooves the employment of fully one third more patrolmen in the Police force alone. I call the special attention of your honorable body to two subjects which deserve which deserve collatral consideratinm sewering and Planking I recommend that hereafter all sewer work be charged for by the City to the abutting property owners according to the front foot. theCity should have an estimate of the average cost for mains and for large medium and small sewers; adding these together will give the proportion that each front foot will have to bear. This will solve the problem now perplexing the council. Every house connecting with a sewer gets the benefit of the main avenues of drainage and should bear its pro rata of the cost. Under the provisions of the Charter for the creation of improvement districts

20

19 and payments by bonds the work will impose no hardship on the property owners although the property will only be assessed for a fixed proportion per front foot. All work should be done by contract and let to the lowest bidder. The difference between the cost and the assessment should be paid unto the sewer find. to be drawn upon in those cases where owing to mains or large pipes being required the assessments is lower than the cost of construction where sewer work or water service is asked for upon streets ungraded, and additional 25 [er cent should be charges to the abutting property ownersto cover the extra cost of laying pipes through stumps and roots. All streets should be graded in district so thereby settled as to require the city to supply water or provide sewers but if for any reason it should be undesirable to insist upon the street bieng frist graded, it might be advisable to supply the demand, provided the additional costs were borne by the interested property owners. The objection might be raised that a portion of the citiy has already been sewered at the general expense. there is some justice in this objection; and to meet it,Ipropose that hereafter all planking, paving and other street inprovements which cost most heavily in those parts where the sewers are already laid, shall be done at the expence of the abutting property owners and not as heretofore, out of the general fund of the City. As the business thoroghfares are travelled by residents of all parts of the City alike and as the expense of keeping those streets in repair is so muchgreater than elsewhere, payment by abutting property owners of these repairs will form eventualy an equitable adjustment of the burden of taxation for services and street improvement. I find that the City Charter requires an independant assessment of property in the city for purpose of taxation. the County Roll can no longer be merely copied as heretofore, this involves an additional expense of no small proportions. I suggest that the County assessor and for a reasonable adition to their pay they would transcribe the returns and be able to officially attest the validity of the City Assessment Roll;