Pages

31

30

This however will not be the result. It will merely call in warrants upon which a discount of 4 per cent has already been carried by investors, who knew when they bought the scrip that is only be redeemed by the sale of bonds yet to be issued, or from taxes to be collected next year. No injustice is therefore done to anybody holding salary warrants. The only effect it could have would be to allow those investors to turn their money over once more and make another 4 per cent. The only saving to the City would be the 10 per cent interest on the scrip already issued to the extent covered by the proposed ordinance but that saving will be fully offset by the increased revenue from the extension of the Water system. On the other hand I cannot think it wist to divert money from the water or sewer fund. thousands of people are suffering for the want of sewers and water supply The City needs every dollar it can devote to those purposes, especially as all money spent on such work goes to the maintenance of laborers of course, whoe will continue tob e paid in coin by virtue of another ordinance but is needed to buy materials for the work from local merchants who do not derive their profil from scrip discounting, and who should get the benefit of cash payments whenever they can be made. If the money is spent upon this material it affords additional opportunity for the employment of labor. Respectfully Submitted (signed) Harry White mayor

32

31

Mayor's Message on Tax Levy Seattle August 13, 1891 To the Honorable Council of the City of Seattle Gentlemen: As you are preparing to enter upon your responsible duty of levying a tax upon the people of the City of Seattle, I invite your attention to the conditionof the city's finances to the causes leading to that condition, and the avenues of relief open to us. As to the causes I need only make general reference as they are too well known to require detailed iteration. It is well understood that whatever difference of opinion there may be as to the wisdom of the extraordinary outlay of the past two years, or the economy in making it, the City has incurred a floating indebtedness represented on the credit side of the account by a thoroughly equipped fire department, lodges in substantial buildings erected on land now owned by the city; by a fire boat whose maintenance is claiming to be defrayed by the savings in insurance premiums; and by miles of solidly planked streets. The value of all this is largely relative but the debt it incurred is absolute, and it is sound public policy to courageously meet it and place it in such shape that the taxpayer can conveniently liquidate it. Delay means highrates of interest, complications, instability, and eventual embarrassment. the property valuation of the City is $44,000,000 According to a recent decision of the Supreme Court, we are empowered by the Constitution toincur an indebtedness not to exceed five per cent of that valuation for general mun-

33

32

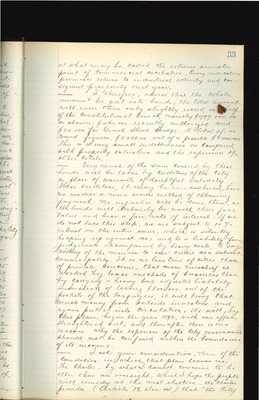

icipal purposes and a further five percent for water supply, sewerage, and lighting: provided we own our own plant. Our limit of indebtedness will, whenthe City Council colses the Assessment Roll, be in the neighborhood of $4,400,000 Of this $2,200,000 is applicable only to the three special purposes named, with these however, I do not think it advisible to deal in this communication. Work is progressing satisfactorily and there is ample margin. I may add that the money spent on the Water System, cannot be considered a debt since the investment pays 5% interest and leaves a large clear surplus with constant increase of revenue. In the near future I hope to see the income so great as to justify a further reduction in the water rates. The City's limit on indebtedness for general municipal purposes is $2,200,000. In this class our funded liabilities are $20,000.00 for the Grant Street Bridge and $460,000 Seattle Funding bonds, now in course of preparation. Our floating indebtedness, for which provision must be made, would seem to be according to the City Comptroller estimates up to January 1sr 1892 as follows: Salary Fund $116,471.45 Fire Dept Fund $110,275.35 Street Fund $113,442.69 Police Dept $ 44,619.06 Salary Fund $ 15,540.95 Salary Fund $ 3,292.30 [SubTotal] $403,642.10 Judgements $143,432.47 Yesler, Rinehart & other Claims $250,000.00 Interest on Bonds to be provided for $ 65,850.00 Total $862,924.57 It would take a levy of 20 milla to cover this. No sane man would propose such a measure in the present financial condition of the City. It will be conceded that some of it must be bonded and the only question is how much of it shall be bonded. The entire country has been this year

34

33

at what may be called the extreme sinister point of commercial oscilation. Every indication promises returns to industrial activity and consequent prosperity next year. I therefore, advise that the whole amount be put into bonds, the total amount will even then only slightly exceed one half of the constitutional limit namely $799,000.00 as shown; $460,000 recently authorized and $20,000 for Grant Street Bridge. A total of, in round figures, $1,280.00 out of a possible $2,200,000 this is a very small indebtedness as compared with property valuation and the experience of other cities. Very much of the sume covered by these bonds will be taken by creditors of the city. In place of warrants of doubtful validity these creditors, it may be remembered, have no readier or more secure method of obtaining payment. No injustice will be done them, as the bonds will certainly be worth then face value and bear a fair rate of interest. If we do not take this step, we are subject to 10% interest on the entire sum, which is silently heaping up against us, and to a liability for judgements accompanied by heavy costs, to say nothing of the menace to our credit as a solvent municipality. It is no less true of cities than of private concerns, that more mischief is worked by loose methods of business than by carrying a heavy but adjusted laibility. Instead of taking $800,000 our of the pockets of the taxpayers, it will bring that much money from outside investors and again put it into circulation, we will, by this plan, begin the year 1892, with our affairs streaghtened out, and thereafter there is no reason why the expenses within the boundaries of its income. I ask your consideration, then of the conditions in which that plan leaves us. The charter-by what I cannot conceive to be other than an oversight, which I hope the people will remedy at the next election- the charter provides (Article IX sec 14) that "the City

35

34

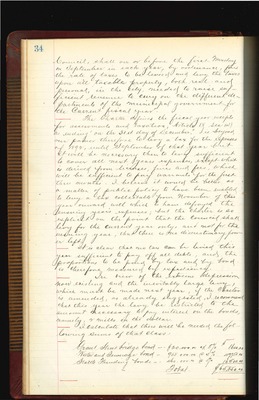

Council, shall on or before the First Monday inSeptember in each year, by ordinance, fix the rate of taxes to be levied and levy the taxes upon all taxable property, both real and personal, in the City, needed to raise sufficent revenue to carry onthe different departments of the municiapl government for the Current Fiscal year. The Charter defines the fiscal year except of assessments and taxation, (Article IV Sec 14) as ending on the 31st day of December" It is beyond our power therefore to levy a tax for the expenses of 1892, until Septembe of that year but it will be necessary then to levy sufficeint to cover all next years expenses, except what is derived from licenses, fines and fees, which will be sufficient to pay warrants for the first three months. I believe it woudl be better as a matter of public policy to have been enabled to levy a tax collectable from November of this year onward with which to have defrayed the ensuing year's expenses; but the Charter is so explicit on the point that the council shall levy for the current year only, and not for the ensuing year, that there is no discretioinaly power left. It is clear no tax can be laid this year sufficient to pay off all debts, and the proportions to be paid by tax and by bond is therefore measured by expediency In view of the extreme depression now existing and the inevitable large levy, which must be made next year, if the charter is amended, as already suggested, I recommend that this year the levy be restricted to the amount necessary to pay interest in the bonds, namely, 2 mills on the dollar. I calculate that there will be needed the following sums of that class: Grant Street Bridge Bond $20,000.00 x 8% $ 1,600.00 Water and Sewerage Bond $955,000.00 @ 5% $47,750.00 Seattle Funding Bonds $460,000.00 @ 5% $16,500.00 Total $65,850.00