Pages

36

35

I am aware that the annual interest on the last named issue amounts to more than $16,400 but it will not draw a full years interest within this levy. A tax of 2 mills on $44,000,000 will yield $88,000. After paying the $65,850 out of this, there will be sufficient left, with the cash now in the interest fund. to pay one half years interest on the proposed issue of bonds needed before the next levy. This will save the cost and annoyance of another small levy before the annual assessment. The relief the taxpayers temporarily obtain will enable them greater freedom to prosecute private works of improvement, and thus place property owners, in a better position to meet the demands to be made upon them in the future. Even with the low rate of taxation I propose for this year I see no reason why the rate to be levied in September 1892. Should be more than 8 or 9 mills on the probable increase of value. Whether it is or not it will be seen by the charter that we have no power to relieve next year's burden by increasing the burden this year. The annexed district and especially the urban portions, Fremont, Latona, Smith's Cove, Edgewater, and Brooklyn, will expect imporvements next year and as they will come within the taxable precincts in April 1st. the work can begin with January 1st. They need City advantages and are willing to pay their share of taxation to get them. the Judgement of the Superior Court sustaining, in effect, my veto of the scrip redemption bonds ordinances, compels us to seek other means of relief. Ihave always insisted that the city should sue contumaciously delinquent property owners for grade taxes. and I am very firm in the conventionthat ia vigorous effort were made a large proportion could be collected . I refer you to the following very decided language of the old charter under which all such street work was contracted for

37

36

Collection of Assessments 'Sec 10 the City of Seattle has power by gen"eral ordinance to prescribe the mode in which 'the costs and expenses of all public improve"ments, which, by the provisions of this Act "are to be provided for and paid by special\ "assessments upon property, shall be divided "apportioned, assessed and collceted. All such 'Special assessments shall be liens upon the "respective lots and parcels of land subject "thereto as provided in the Act. From the "date of the ordinance levying such assess"mant. Such assessment may be collected and "such liens may be enforced by action at law "or suit in equity either in the name of the "City of Seattle or of the Officer on any Contractor 'or Contractors, to whom it shall have directed "payment to be made; and in any such action "or suit, it shall be a sufficient statement "of the cause of action in the complaint to "allege the making and completion of the "improvment, describing it and the amount "of the assessment on the premises proceeded "against giving an accurate description thereof "and the amount of such assessments reamain"ing unpaid and the names of the owner of "and each person having an interest in, "such premises at the time of commencing "the action or suit. In any such action, "or suit, it is shall appear to the court on "the trail thereof that work has been done "or materials furnished, in making improve"ments authorized by the Council for which "under the provisions of this act, special assess"ments may be levied the Court shall decree 'against the premises and in favor of the City "or other proper party plaintiff, to the extent "of the proportion of the reasonable "of such work of materials justly charge"able to such premises notwithstanding "any defect, informality or irregularity in "the proceedings. But in such case, if "defects informalities of irregualarities pre"judicial to the party objecting on account "thereof appear, the court, in its discretion

38

37

"may disallow any part or the whole of the "plaintiffs costs or allow cost to the defendant; "and if the assessment proceedings shall "appear to be regularmthe plaintiff shall be "entitled to include in the recovery the "full amount of the assessment and "interest thereon at the rate of 10 per cent "per annum from the time when the "assessment shall have becpme delin"quent and 5 per cent additional as "penalty for damage and delay." I appeal to you to have no more delay about this supremely important matter. Put the entire amount in default into the hands of the Corporation Counsel. If property owners cannot pay, but are willing to pay they can take refuge in the provisions of the ordinance you have already passed, allowing them to pay by installments The first installment fixes their liability, refer the question to the arbitratrament of the Court. It is impossible for the Corporation Counsel to deal with such a vast number of cases in the short time available. I recommend therefore, that you authorize him to employ the best legal assistance her can get. The cost of the suit goes to Court is of little importance as the defendant, if he determine upon resistance must take the consequences of as adverse judgement with costs to follow, The Supreme Court has decided that for street gradingm the "payment by Bonds" plan cannot be adopeted, except by a vote of the people. This throws us back upon immediate payment plan, which seems to be very inadequately comprehended. In effort it gives from one year to nearly two years grace for payment, because under the new charter such assessments are to be enforced in the same way as city taxes. It is very desirable that as much street grading as possible be done at once in anticipation of the laying of water and sewer mains,

39

38

which is more expensive on ungraded streets one very important point arising in connection with this subject is the necessity for a change of policy as to maintianing streets in the business district. The taxpayers have undertaken to pay for most of the planking done within the past two years, but I am satisfied it would be unjust to impose further expenditure of that kind upon them. The present planing will wear out and it should be replaced by paving of substantial and uniform material laid at the expense of the benefitted property and assessed by the front foot. There will be no difficulty in disposing of Warrants issued for the purpose under the stringent lien provided by the Charter, which had all the force and effect State law, and it affords the most ample security to contractors and scrip buyers. The people of Seattle do not realize the vast sum paid out within two years for street improvements. In 1889-90 it amounted $233,176.16 And in 1890-91 up to June 1st to $145,896.15 Altogether $379,073.31: Including interest it runs to over $400,000. Most of which was for planking the entire tax levy for 1889-90 at 12 mills in $16,000,000 was $192,000. In 1890-91 at 10 mills on $26,000,000 it was $260,000. Altogether in two years the tax levy was $452,000 and the street work alone was nearly equal to that Is it any wonder the city must come to a halt? The fact is the amount I advise not to be bonded, should have been bonded long ago If an attempt had been made to pay that amount by taxes levies then it would have necessitated an average tax levy of 20 mills instead of 12 for 1889 and 18 mills instead of 10 last year. Under the new charter, contractors and scrip buyers must looks to property owners forpaymetn and one excellent effect is that self interest willl ensue, ther shall be irregularities or informalities in passing the ordinances or other legal formalities such as have arisen inthe past to the City's detriment. I call your attention once more

40

39

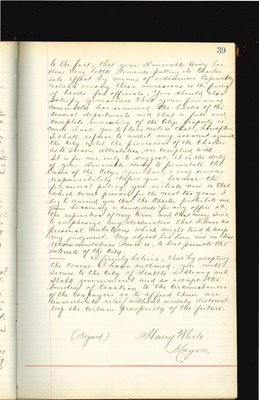

to the fact, that your Honorable Body has done very little towards putting its Charter into effect by means of ordinances. Especially notable among these omissions is the fixing of bonds for officials. You should also satisfy yourselves that your finance committee has examined the books of the several departments and that a full and complete inventory of the City's property is made. I ask you to take notice that,hereafter I shall refuse to audit any account against the City until the provisions of the charter as to sworn attestation are complied with It is for me only to suggest it is the duty of your Honorable Body, to formulate the laws of the City, you have a very serious responsibility before you because the financial policy you initiate now is that whic must prevail for the next two years. I beg to remind you that the Charter prohibits no from becoming a candidate for any office at the expiration of my term and that may serve to emphasize my declaration that I have no personal ambitions which might tend to warp my judgement, My object has been and in there recommendation noneis to best promote the interests of the city. I firmly believe that by adopting the course I have outlines, you will secure to the City of Seattle a strong and stable gevernment and so adopt the burdens of taxation to the circumstances of teh taxpayer as to fford them an immediate relief without unduly discounting the certain prosperity of the future.

(signed) Harry White mayor