Pages

7

To the Honorable Finance Committee of the City Council,

Gentlemen:

In accordance with your request for my opinion upon the matters referred to in the attached petition, I would respectfully say that the only question arising under the facts appearing from the papers necessary to be considered is as to whether or not the description given in the assessment is a valid description upon which a foreclosure of the tax lien can be had.

The assessment reads, Lot 6 Block B Tucker's Addition. It appears from an inspection of the maps of the city of Fort Worth that there is no Block B in Tucker's Addition other than Block B of the subdivision of Block 57 of Tucker's Addition. Tucker's Addition as the same is known on the maps of the city of Fort Worth was laid off by the elder Tucker, where as I understand the facts to be the subdivision of Block 57 was made by the Tucker heirs for purposes of partition, streets therein being reserved.

On the facts as represented to me I am inclined to think that the description is not a correct description of any particular piece of property that is sufficiently definite to act as the basis for a legal proceeding as much greater strictness is required than in deeds between parties. I would not be willing, however, to state positively that this description is bad on account of the fact that though Block B is a part of the subdivision of Block 57, it is nevertheless the only block B of any character or description in said Tucker's Addition, and the question is one that can be definitely settled only by a resort to the courts. I think that the question is one of grave doubt, my inclination being towards the fact that the same is not valid.

This is one of those cases in which it is impossible with any degree of definiteness to judge what a court would do upon the point involved. If the description is invalid the property would still be liable to reassessment, but the city would have to pay the costs of the proceeding and

8

-2-

the assessed valuation might not be so high if assessed now as it was when assessed in the years 1893 to 1899 inclusive.

Under all the circumstances if the committee should deem it proper to consider the question of accepting the taxes tendered, my opinion on the matter would be that they would have authority to accept the same as a compromise of a litigated question as to the result of which considerable doubt must necessarily exist under the facts in this case.

Very respectfully,

E.C. Orrick City Atty

9

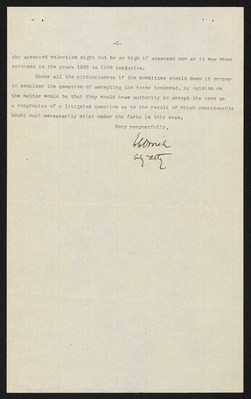

P 136

DEPUTIES: R.G. LITTLEJOHN. W.B.MARTEL. L.E.DAY.

OFFICE OF W. J. GILVIN, City Assessor and Collector.

Bring this STatemetn with you when you come to pay taxes.

Fort Worth, Texas, 6-3-1904

R H Tucker for Mrs C. B. Read.

______________________

__________________, In compliance with your request of ______________ the following information in relation to lands described, is furnished from the records of this office:

DESCRIPTION OF LANDS

| YEAR | LOT | BLOCK | ADDITION | VALUE | TAX | COST | INTEREST | TOTAL |

|---|---|---|---|---|---|---|---|---|

| 1903 | 6 | B | Tuckers | 700 | 12.25 | 61 | 12.86 | |

| 1902 | " | " | " | 600 | 10.50 | .25 | 179 | 12.54 |

| 1901 | " | " | " | 400 | 7.00 | .25 | 202 | 9.28 |

| 1900 | " | " | " | 400 | 7.00 | .10 | 287 | 9.87 |

| 1899 | " | " | " | 800 | 12.00 | 636 | 18.36 | |

| 1898 | " | " | " | 700 | 10.50 | 683 | 17.33 | |

| 1897 | " | " | " | 750 | 11.25 | 866 | 19.91 | |

| 1896 | " | " | " | 750 | 13.13 | 29.15 | 13.13 | |

| 1895 | " | " | " | 700 | 12.25 | 12.25 | ||

| 1894 | " | " | " | 700 | 10.85 | 10.85 | ||

| 1893 | " | " | " | 700 | 9.31 | 9.31 | ||

| 117.04 | 146.79 | |||||||

| 29.15 | ||||||||

| 117.64 | ||||||||

| 145.89 |

10

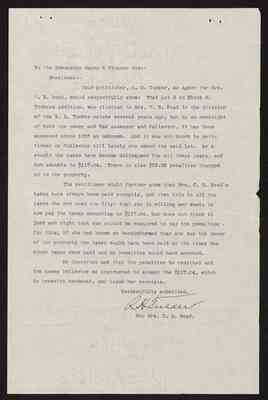

To the Honorable Mayor & Finance Com:-

Gentlemen:-

Your petitioner, R. H. Tucker, as Agent for Mrs. C. B. Read, would respectfully show: That Lot 6 in Block B, Tuckers Addition, was allotted to Mrs. C. B. Read in the division of the W. B. Tucker estate several years ago, but by an oversight of both the owner and Tax Assessor and Collector, it has been assessed since 1893 as unknown. And it was not known to petitioner or Collector till lately who owned the said lot. As a result the taxes have become delinquent for all these years, and now amounts to $117.04. There is also $29.85 penalties charged up to the property.

The petitioner would further show that Mrs. C. B. Read's taxes have always been paid promptly, and that this is all the taxes she now owes the City; that she is willing and wants to now pay the taxes amounting to $117.04, but does not think it just and right that she should be required to pay the penalties - for this, if she had known or beeninformed that she was the owner of the property the taxes would have been paid at the times herother taxes were paid and no penalties would have accrued.

We therefore ask that the penalties be remitted and the taxes Collector be instructed to accept the $117.04, which is herewith tendered, and issue her receipts.

Respectfully submitted, R.H. Tucker For Mrs. C. H. Read.